Rich Builders, Poor Makers

What kind of entrepreneur do you want to be?

In his famous book, Rich Dad Poor Dad (1997), Robert T. Kiyosaki wrote how his friend’s father (“Rich Dad”) managed to accumulate wealth and obtain financial security while his own father (“Poor Dad”) worked hard all his life and struggled with money. His rationale lies in the financial concepts of assets and liabilities: An asset is what puts money in your pocket even when you’re sleeping, a liability is what takes money out of your pocket even when you’re working. Rich Dad buys or creates assets and minimizes liabilities.

I see a similar pattern among the types of entrepreneurs: Those who can build a great company—an asset—and eventually succeed to become Rich Builders, and those who are exclusively focused on making an original product. The latter (Poor Makers) are more likely to fail. Brian Chesky, CEO of Airbnb, said: “it doesn’t matter how great your original idea is. If you cannot build a great company, then your product will not endure”. You build a company, and you make a product. The difference between the two is the (relative) permanence of the building.

What is a great company?

I like this definition from Jim Collins, author of the bestseller Good to Great, who explains in a video the three achievements in building a great company: “superior results, distinctive impact, and lasting endurance”. To me, the latter is certainly the most representative of success. A great company is an enduring company. It endures because it can generate superior results and make a distinctive impact.

The legendary venture capital firm, Sequoia Capital, listed eleven key elements that, according to the team, give startups the best shot at becoming enduring companies. Some of these elements seem obvious, such as addressing large markets or “choosing the first few hires wisely”. Others are more surprising but as critical such as clarity of purpose, frugality, and, my favorite one, inferno: “Start with only a little money. It forces discipline and focus. A huge market with customers yearning for a product developed by great engineers requires very little firepower”.

From a purely financial perspective, a great company is an asset that generates financial returns above investors’ expectations (e.g., they expect 15%, but the asset returns are 30%). People who build such company assets manage to capture a lot of value from the market. Their companies are like powerful magnets attracting customers who are willing to pay a higher price for their product, and investors willing to invest at a premium valuation. If you are on the selling (entrepreneur) side, you can take advantage of it by marketing yourself as an asset builder and not just as a product maker.

The two pitfalls to avoid

When you start a business, you don’t necessarily care about building a company. You just want to make an original product for solving a problem, realize your idea, showcase what you are capable of, raise seed funds, and reach the market. This process is undoubtedly central and deserves the right attention. However, making something new is addictive if you let yourself be enchanted by the journey of creation, escaping the building's harsh reality. Roelof Botha, Sequoia partner, gave a great piece of advice to entrepreneurs: “Founders should think of their company as a product and build it and shape it with the same passion and care” (source: Fred Wilson). Your product is your company.

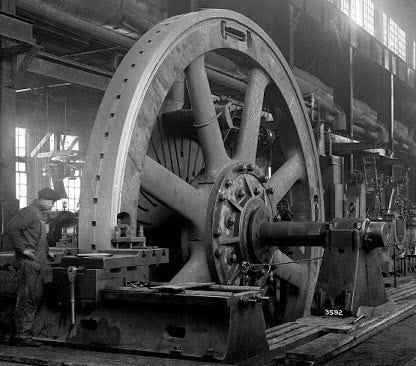

Assuming you have taken this important step, you must be aware of another pitfall: the flywheel effect. Jim Collins used this metaphor to describe the slow, invisible, sometimes discouraging, process of creating business momentum: “In building a great company or social sector enterprise, there is no single defining action, no grand program, no one killer innovation, no solitary lucky break, no miracle moment. Rather, the process resembles relentlessly pushing a giant, heavy flywheel, turn upon turn, building momentum until a point of breakthrough, and beyond”. In other words, you must keep doing what you do with discipline and consistency. Be patient. It takes time to see results, not months, but years, and sometimes decades.

The necessary transition from making to building

What happens if you don’t transition? You keep developing an original product, but this product remains a liability. It never turns into an asset because there is no organization or business system to support it in the long run. If you don’t realize it soon enough, you may end up with one of these three unpleasant options: a bankruptcy, a product trade sale, or an acquihire by a well-established company. There is no need to mention that the lowest possible valuation would apply to the last two transactional options.

To transition, you must create both organizational and business systems. Below, I structured six principles that I think are instrumental in building these systems. The first three principles relate to intangible elements and human capital; the last three principles relate to tangible elements and financial capital.

Create an efficient brand: A brand is not about graphic identity, and it is not limited to having a vision. If you have one, that’s great, but it is not a brand. According to Sue Mizera, managing partner at Torchfish, a brand comprises nine elements: vision, mission, target, offering, personality, promise, core values, name, and differentiation. You must coherently work on all of these elements to build an efficient brand. See this short video to know more.

Set up a high-functioning team: this principle is not just about finding and recruiting the best talent for a job. To build such a team, you need more than competitive incentive plans. As in the Netflix example, you want to have an inspiring brand and to develop a strong corporate culture to keep people unified and steady, whatever the external situation.

Interact with your community: continuous interactions with your community constitute the best way to validate what people want, both at launch and at scale. Your community is your guide to discovering hidden market needs in your industry. If a large community has your back, you are in an excellent position to grow fast with less spending on marketing and with more financial freedom.

Follow a niche-to-mass market plan: start by manually addressing a few rich customers who have a critical problem, are willing to move fast, and can pay a premium price for your product. Make these few customers very happy. Then, grow from there to reach a niche market that can become a mass market. Whatever the stage you are in, make sure your business can grow.

Build an economic engine: there are two types of economic models—the fuzzy ones and those with strong unit economics. The latter validate everything: the problem, the solution, the product-market fit, the potential, the monetization, and the scaling—all in one. Strong unit economics built into a business system becomes an economic engine or, if you prefer, a money-making machine.

Master your return/risk rationale: finance is mainly a matter of the return and risk rationale. All stakeholder categories (e.g., entrepreneurs, investors, employees, advisors) want the same thing: to maximize their return or minimize their risks, ideally both. To align interests and create long-term value, one must know, talk, and walk this rationale.

Everyone can be a builder. The primary qualification is being aware of what it takes and how long it takes to build. Start as early as possible and continue with discipline, consistency, and patience.

Make, then build.